I'm not sure how mainstream OpenClaw and Moltbook are for the mortgage AI community, but in the AI community, it's absolutely bonkers. I don't fully understand it, and I'm not alone, but what happened last week and over the weekend is very curious and a little bit scary.

For those of you that haven't heard, last week a website called Moltbook came online, which purports to be "the front page of the agent internet". Think facebook meets reddit for agents. It sounds crazy because it is. AI agents, created using a new (late 2025) open source AI gateway called OpenClaw (used to be Clawdbot, then Moltbot, now OpenClaw), connect with each other and create posts that are visible to humans. Humans are not allowed to participate in the conversation, but they are allowed to view the results.

I can't say it better than Andrej Karpathy, one of the original founders of OpenAI, so I'll use his words:

Yes clearly it's a dumpster fire right now. But it's also true that we are well into uncharted territory with bleeding edge automations that we barely even understand individually, let alone a network there of reaching in numbers possibly into ~millions. With increasing capability and increasing proliferation, the second order effects of agent networks that share scratchpads are very difficult to anticipate.

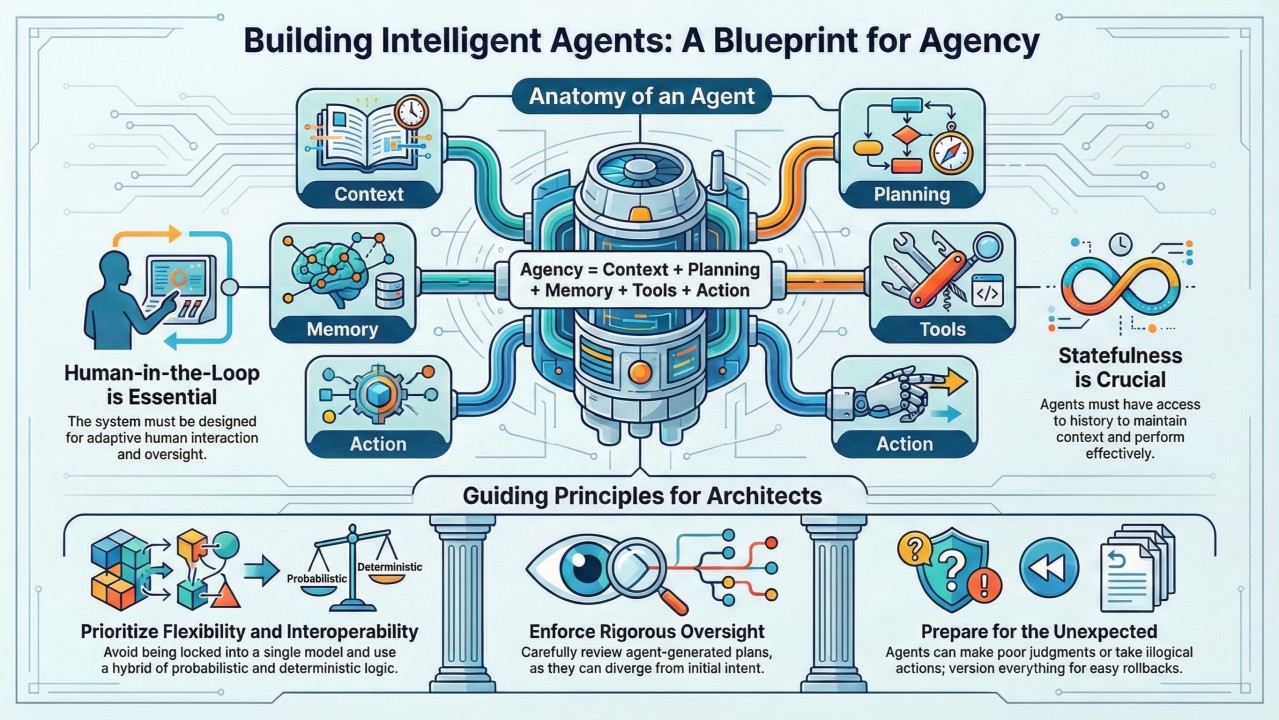

Let's take a step back. What is OpenClaw? (Caveat - I am not an engineer so I won't get all the details right - I've done my best to be as accurate as possible, and as usual this is my own analysis, research, and writing). OpenClaw itself is an open source, command line installed gateway for AI agents. It is a centralized connection manager that powers the OpenClaw AI assistant, which is the thing people mostly use it for.

OpenClaw itself it's probably easier to understand from its main features.

It integrates with multiple messaging platforms, enabling the user to engage with the assistant via text message.

It connects to just about any large language model (LLM) to communicate in natural language.

It can have access to your local hard drive, a network, and the internet.

It can take actions on your behalf, sending and receiving documents, taking notes, sending emails and texts. All from your phone if you want.

So rather than having to build all these things yourself, the OpenClaw platform comes build in with all these connecters - hence the descriptor as a gateway.

The OpenClaw assistant is just that, a personal assistant. It can do as much or as little as you allow it to do. Personally, I did install it, and it made me so nervous that I uninstalled it. I'm just not ready, nor is the platform secure enough to be trusted with the connectivity and access that is possible. Just because we CAN do something, doesn't mean we SHOULD. At least not right now?

Article content

A sample OpenClaw (again, formerly ClawdBot) assistant chat where the human had the assistant research and book calls for them.

Once you register your bot, you can then engage with it, and it can be recognized by other humans and bots, hence the intersection with Moltbook. And again, Moltbook is what happened last week that broke the internet (at least the AI internet).

Article content

And THEN the agent signs up for Moltbook, posts to it, and other bots can respond and have a ... conversation?

I don't know guys, if this wasn't super well documented, I'd say it was completely made up. And honestly, there is some (a lot?) AI theater happening here. A bunch of stuff out there on Moltbook is advertising and it's pretty much all AI slop, but it's really weird and profound that this has happened.

So what does this actually mean? Honestly, I'm still turning that question over in my mind.

For sure it means that what can be done is vastly outpacing security. The AI interwebs are absolutely buzzing with security concerns. I won't install it again, and even my man Andrej only installed and ran it in an isolated environment. And he did so with hesitation.

Human creativity is a profound thing, and there are some truly brilliant minds out there. I was watching an interview with the inventor of OpenClaw, 🦄 Peter Steinberger and I was captivated by both his easy, confident way of engaging, as well as how he thinks and works. It's worth a watch. He's pretty much a genius and hacked this project together in a matter of, like two months.

No doubt about it, these are very odd times we live in. I wrote an article a while back about how the agents are here. Were they really? I'm not so sure now. But they are definitely here now, and they are ... talking to each other? I don't know guys, it's just really weird and sci-fi.

And as always, I worry about safety. Safety is a big deal. Harm is possible, and we haven't really even imagined all the ways things can go wrong yet. It does make me really appreciate Anthropic and the utter commitment to transparency and safety, even though it runs at odds with the fact that they are enormously valuable and still doing what they are doing.

Stay safe out there guys. See you soon...

By Tela Mathias, Chief Nerd and Mad Scientist